Cares act 401k withdrawal taxes calculator

The penalty is an. Ad E-File your tax return directly to the IRS.

Taxes On 401k Distribution H R Block

As a result it.

. How Does a CARES Act 401 k Withdrawal Work. The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. This calculator compares employee contributions to a Roth 401k and a traditional 401k 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will result in a penalty An early.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Discover Helpful Information And Resources On Taxes From AARP. New tax-free contributions are not repayments.

Calculate your tax refund and file your federal taxes for free. Ad IRA Withdrawal Calculator Required Minimum Distribution Traditional IRA Roth IRA. The tax that you will owe is the tax on ordinary income at your margional tax rate so to avoid an underpayment penalty you can make estimated tax payments.

Retirement Withdrawal Calculator Retirement Plan more. The Act provided specific aid and tax benefits for taxpayers who needed to withdraw more money than usual from their retirement and 401 k plans during the pandemic. If you withdraw 40000 you must pay taxes on that 40000 for the tax year.

December 4 2021 806 AM. The United States Government recognized the hardship COVID-19 presented to individuals and created the Cares 401k act. Prepare federal and state income taxes online.

Normally withdrawals made from a tax-deferred retirement account by a participant who has not reached the age of 59 12. Ad If you have a 500000 portfolio download your free copy of this guide now. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

The CARES Act and 401k withdrawal. One less-noticed part of the bill though changes the way that pre-retirement withdrawals from retirement plans work. At this point there are no changes to your tax return and you will still pay tax on.

Ad If you have a 500000 portfolio download your free copy of this guide now. If the pandemic has had negative effects on your finances temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency withdrawal. Use our 401k withdrawal calculator to explore your specific situation This distribution can be taxed evenly as income through tax year 2022 and taxes paid within that three-year period may.

401k Withdrawal Calculator Cares Act. Section 2022 of the CARES Act allows people to take. Simply put the Cares Act 401k Withdrawal allows.

Usually if you are younger than 59 and make an early. Use this calculator to estimate how much in taxes you could owe if. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

In general section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to 100000 of coronavirus-related distributions from eligible.

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial

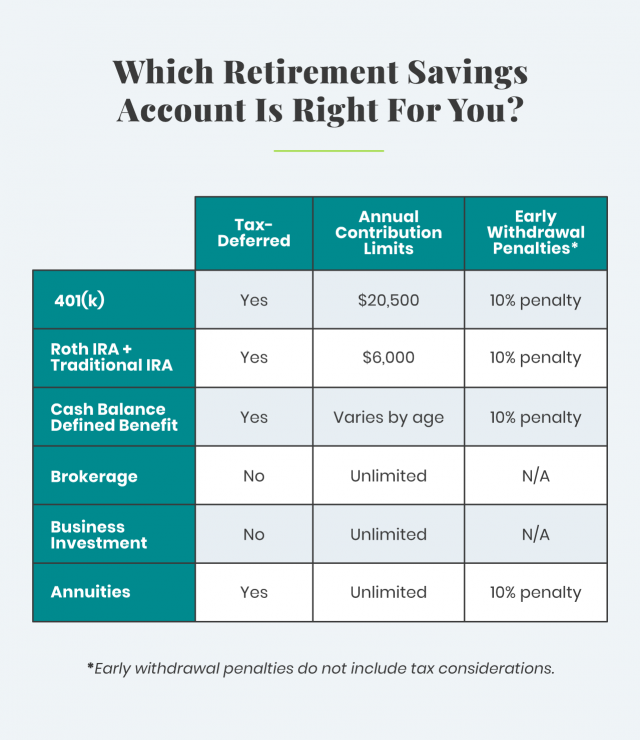

401 K Alternatives To Save For Your Retirement

Avoid Costly Tax Mistakes Ira 401 K Withdrawal Pe Ticker Tape

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

Rule Of 55 For 401k Withdrawal Investing To Thrive

1

401 K Hardship Withdrawal Rules 2021 Myubiquity Com

1

401k Plan Loan And Withdrawal 401khelpcenter Com

Retirement

Should You Make Early 401 K Withdrawals Due

401 K Hardship Withdrawal Rules 2022 Ubiquity

3

Cares Act 401k Withdrawal Edward Jones

After Tax 401 K Contributions Retirement Benefits Fidelity

401 K Withdrawals What Know Before Making One Ally

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity